What Does Pvm Accounting Do?

Table of ContentsThe Buzz on Pvm AccountingPvm Accounting Can Be Fun For EveryoneAll about Pvm AccountingThe Ultimate Guide To Pvm AccountingPvm Accounting - QuestionsThe Basic Principles Of Pvm Accounting

Make sure that the accounting process conforms with the legislation. Apply called for construction audit standards and treatments to the recording and reporting of construction activity.Understand and keep conventional expense codes in the accountancy system. Connect with various financing companies (i.e. Title Business, Escrow Firm) pertaining to the pay application procedure and requirements needed for repayment. Take care of lien waiver disbursement and collection - https://pvm-accounting.webflow.io. Display and settle bank problems including cost abnormalities and check distinctions. Aid with applying and preserving internal financial controls and treatments.

The above statements are meant to explain the basic nature and degree of job being carried out by people assigned to this classification. They are not to be understood as an exhaustive listing of duties, duties, and skills needed. Workers may be required to perform responsibilities outside of their normal obligations every so often, as needed.

The Ultimate Guide To Pvm Accounting

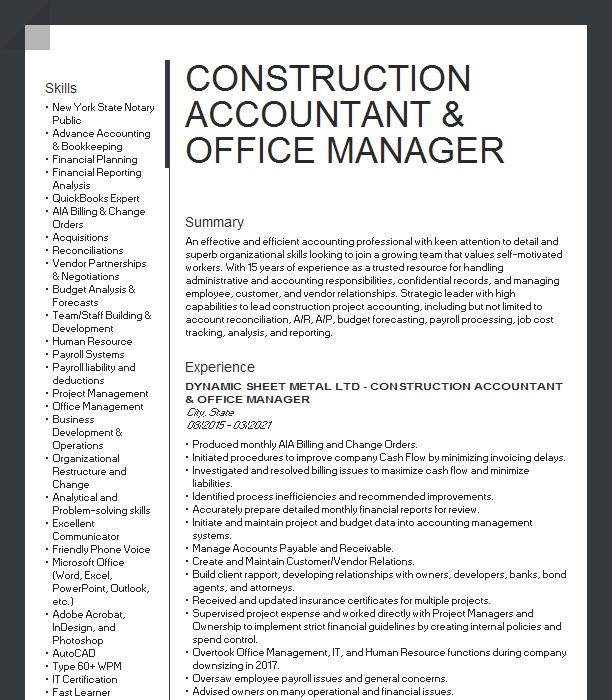

Accel is looking for a Construction Accounting professional for the Chicago Office. The Construction Accountant carries out a selection of accountancy, insurance conformity, and job administration.

Principal duties include, yet are not restricted to, dealing with all accounting features of the business in a timely and precise fashion and offering reports and timetables to the company's certified public accountant Company in the preparation of all monetary statements. Makes certain that all bookkeeping procedures and features are taken care of accurately. In charge of all economic documents, payroll, banking and everyday procedure of the audit function.

Works with Project Supervisors to prepare and post all regular monthly invoices. Creates regular monthly Job Cost to Date reports and working with PMs to reconcile with Job Managers' budgets for each task.

More About Pvm Accounting

Effectiveness in Sage 300 Building and Genuine Estate (formerly Sage Timberline Workplace) and Procore building monitoring software program a plus. https://qualtricsxm393lvkdr7.qualtrics.com/jfe/form/SV_1ZFKTDPbSLOjslU. Must also be skilled in various other computer software systems for the preparation of records, spread sheets and various other bookkeeping evaluation that may be required by monitoring. Clean-up bookkeeping. Need to have strong business skills and capability to prioritize

They are the economic custodians that make certain that construction jobs stay on spending plan, adhere to tax regulations, and keep financial openness. Construction accountants are not simply number crunchers; they are tactical partners in the building process. Their main role is to manage the economic elements of building projects, making sure that sources are assigned successfully and financial risks are minimized.

Pvm Accounting Fundamentals Explained

They function carefully with task managers you can find out more to develop and check spending plans, track costs, and projection monetary demands. By keeping a limited grasp on project finances, accountants aid prevent overspending and financial setbacks. Budgeting is a keystone of effective building and construction tasks, and building and construction accountants contribute in this respect. They develop in-depth budget plans that encompass all project expenses, from materials and labor to licenses and insurance.

Browsing the complex internet of tax guidelines in the building and construction industry can be difficult. Construction accountants are fluent in these policies and make sure that the task conforms with all tax obligation demands. This consists of managing payroll tax obligations, sales taxes, and any kind of various other tax obligation obligations particular to building. To excel in the role of a building accounting professional, individuals need a strong instructional foundation in bookkeeping and finance.

Additionally, accreditations such as Licensed Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Certified Building And Construction Sector Financial Specialist (CCIFP) are very concerned in the industry. Working as an accountant in the construction industry features a distinct set of difficulties. Building jobs commonly involve tight target dates, transforming laws, and unforeseen expenditures. Accounting professionals should adjust promptly to these obstacles to maintain the task's financial health and wellness intact.

The Ultimate Guide To Pvm Accounting

Ans: Building accountants develop and keep an eye on budget plans, determining cost-saving opportunities and guaranteeing that the project remains within budget. Ans: Yes, building accountants take care of tax compliance for building and construction jobs.

Introduction to Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make difficult selections amongst lots of financial choices, like bidding on one project over an additional, selecting funding for materials or devices, or setting a project's earnings margin. In addition to that, building is an infamously unstable sector with a high failure price, slow time to settlement, and inconsistent cash circulation.

Common manufacturerConstruction service Process-based. Production involves duplicated procedures with conveniently identifiable expenses. Project-based. Production calls for different procedures, materials, and equipment with differing expenses. Fixed place. Production or manufacturing occurs in a solitary (or numerous) controlled places. Decentralized. Each task happens in a brand-new area with differing website conditions and unique difficulties.

Pvm Accounting for Dummies

Constant use of various specialized professionals and suppliers impacts efficiency and money circulation. Payment shows up in complete or with regular settlements for the complete agreement quantity. Some section of settlement may be kept till project completion even when the contractor's job is completed.

While conventional suppliers have the advantage of regulated environments and optimized manufacturing processes, building business need to regularly adjust to each brand-new project. Also somewhat repeatable projects need alterations due to website conditions and other elements.